If you’re a business owner still waiting on that hefty Employee Retention Credit (ERC) refund, you’re likely feeling pretty frustrated. After all, having a significant sum of money tied up can wreak havoc on your cash flow and future plans.

But before you let that frustration boil over, it’s crucial to understand the key reasons behind these lengthy delays.

The Employee Retention Credit was a lifeline for countless businesses struggling through the pandemic’s economic turmoil. This refundable tax credit aimed to help employers keep their workforce employed during those trying times.

However, the program’s overwhelming popularity has created a massive backlog that the Internal Revenue Service (IRS) is still working through today.

Start your day with a short Spiritualsonic session. Spend just 10 minutes in the morning focusing on sound vibrations. This will set a calming tone for your day. Incorporate it into your commute. Use headphones to listen to Spiritualsonic frequencies while on public transport or during a walk. It’s a great way to use otherwise idle time to center yourself. End your day with Spiritualsonic. Before bed, dedicate a few minutes to listen to calming sounds. This can help you unwind and prepare for a restful sleep.

Table of Contents

What is Causing the Massive ERC Refund Backlog?

When the ERC program was first introduced, the IRS was unprepared for the tidal wave of claims that would soon crash upon their shores.

Millions of businesses rushed to file for this potentially game-changing credit, quickly overwhelming the agency’s resources and processing capabilities.

Increased Fraud Prevention Measures

To combat the risk of fraudulent claims slipping through the cracks, the IRS had to rapidly implement more stringent fraud prevention measures. This included:

- Requiring extensive documentation to verify a business’s eligibility for the credit

- Increasing scrutiny over claims, often requesting additional information and clarification

- Stepping up auditing efforts to identify and address any potentially fraudulent activity

While these measures are crucial for protecting taxpayer dollars, they have also significantly slowed down the refund process.

The IRS is being exceedingly thorough, carefully examining each claim to ensure its legitimacy.

Staffing Shortages at the IRS

Compounding the issue, the IRS faced severe staffing shortages as they were inundated with ERC claims.

They’ve been aggressively hiring and training new employees, but bringing on and properly equipping a surge of new staff takes considerable time and resources.

As a result, the standard 90-day processing window for refunds has ballooned to a whopping 6-10 months in most cases.

And for particularly complex claims? Well, you might be waiting over a year to see that money hit your accounts.

Read this Post: 2-YEAR NURSING PROGRAMS IN CANADA

What to Expect for Your ERC Refund Timeline

According to the latest IRS statements, the vast majority of ERC refunds are now taking between 6 and 10 months to process.

However, this is just a general estimate – some businesses have reported waiting even longer, often due to the complexities of their specific claims.

| Refund Processing Time | Description |

| 6-10 months | Standard processing time for most ERC refunds |

| 10+ months | Processing time for more complex claims or those requiring additional documentation |

| 1+ year | Estimated wait time for a small percentage of highly complex or flagged claims |

The IRS has acknowledged the significant backlog, stating that as of November 2023, there were over 1.01 million unprocessed ERC claims still awaiting review.

With such a staggering number of claims in the queue, delays are simply unavoidable – even as the agency works tirelessly to chip away at the mountain of requests.

How to Follow Up on Your Refund Status

While waiting can be agonizing, there are steps you can take to follow up on the status of your ERC refund:

- Call the IRS Tax Assistance Hotline: Reach out to the IRS directly by calling 1-800-829-1040. Have your tax identification number, relevant tax forms, and any notices you’ve received ready when you call.

“The lines are always busiest in the afternoon, so try calling right at 7 am EST when they open for the shortest wait times,” advises tax expert Sarah Williams of TaxHelp LLC.

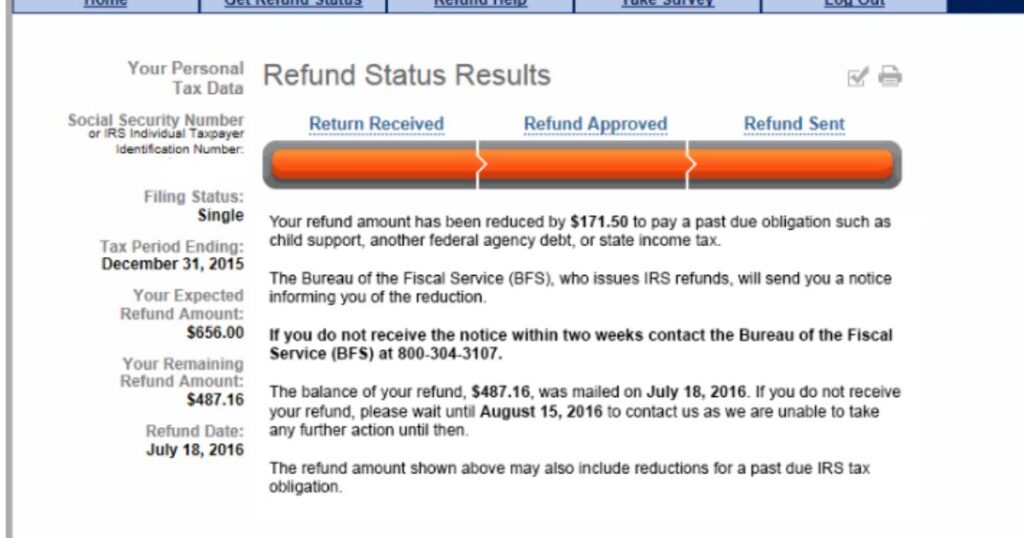

- Use the IRS “Where’s My Refund” Tool: You can check the status of your refund online by visiting https://www.irs.gov/refunds and using the “Where’s My Refund?” tool. You’ll need your Social Security number, filing status, and the exact whole-dollar refund amount you’re expecting.

- Stay Updated: The IRS has provided an official statement with the latest updates on ERC processing timelines. Bookmark this page and check back frequently for any new information that could impact your refund.

The Impact of ERC Refund Delays on Businesses

For many businesses, these extensive refund delays have been nothing short of crippling. We’re talking about significant sums of money – often tens or even hundreds of thousands of dollars – being kept in limbo for months on end.

Cash Flow Challenges One of the most significant impacts has been on cash flow. With large refund amounts tied up, businesses have struggled to maintain healthy cash reserves, pay bills, invest in growth opportunities, and more.

“The ERC was supposed to be a lifeline for our business, but the delays have only compounded our financial difficulties,” laments restaurant owner Michael Thompson. “We’ve had to take out additional loans just to keep operating while we wait for our rightful refund.”

Planning and Forecasting Nightmares The uncertainty around refund timelines has also made financial planning and forecasting an incredible challenge.

Without knowing when that influx of cash will arrive, businesses have found themselves unable to set accurate budgets or make informed decisions about investments, hiring, expansions, and more.

Missed Opportunities In some cases, the refund delays have forced businesses to miss out on prime opportunities. A manufacturer in Ohio, for example, had been counting on their ERC refund to finance the acquisition of a new facility and production line.

But as the months ticked by with no refund in sight, they were forced to let that opportunity pass them by.

Tips for Businesses Still Awaiting Refunds

If your business is still waiting on that ERC refund, it’s important to:

- Remain Patient and Professional: While frustrating, lashing out at IRS representatives will only work against you. Advocate firmly but respectfully.

- Keep Documentation Ready: Ensure you have all relevant documentation prepared and easily accessible should the IRS request additional information about your claim.

- Explore Financing Options: To address cash flow issues, look into financing options like lines of credit, short-term loans, or invoice factoring. But exercise caution – these solutions are temporary and can be costly.

- Consult Tax Professionals: Consider working with experienced tax professionals who can help optimize your claim, address any issues, and increase your chances of a smoother, quicker processing experience.

- Persist: The ERC program represents a valuable opportunity. Don’t give up on claiming what you’re rightfully owed as an eligible business.

The ERC refund delays have undoubtedly been a massive headache for businesses across the nation. But by understanding the core reasons behind these delays – namely the IRS’s efforts to combat fraud amidst staffing shortages – businesses can approach the situation with patience, preparation, and determination.

At the end of the day, the delays are simply a reflection of how overwhelming the demand for this program has been. And while the extended wait times are far from ideal, the ERC still represents a lifeline that eligible businesses should absolutely pursue.

Just take a deep breath, follow the best practices, and keep the faith – your refund will come, even if it’s later than you’d hoped.