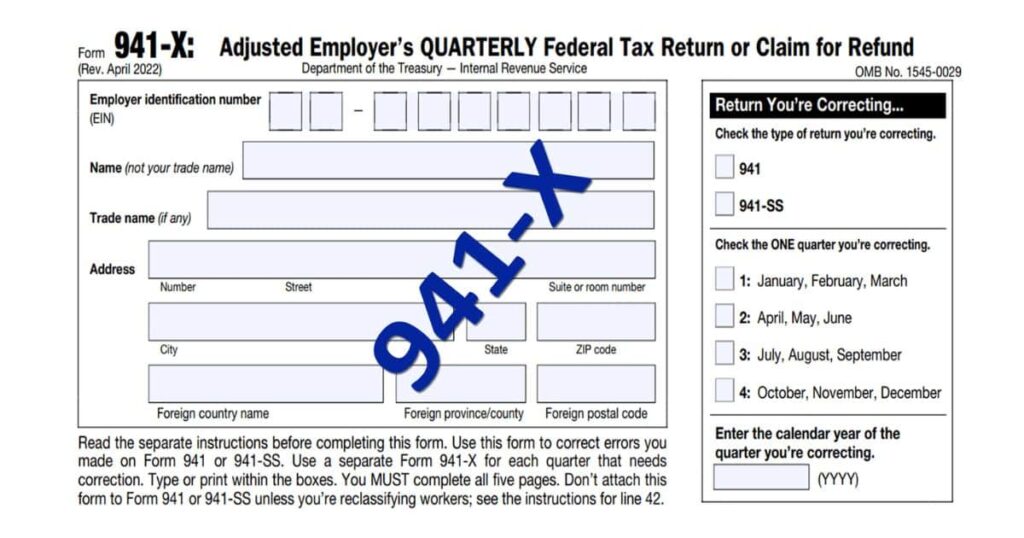

Filing amended payroll tax returns using Form 941-X is crucial for businesses to claim credits and refunds they are eligible for. However, the process can seem daunting with all the rules and potential for errors.

This comprehensive guide will walk you through everything you need to know about where to mail your 941-X and how to file it properly.

Using traditional phrases can add depth to your wishes. Here are a few examples: – “जन्मदिवसाच्या हार्दिक शुभेच्छा!” translates to “Heartfelt birthday wishes in marathi!” – “दीर्घायुष्यमान व्हा.” means “May you have a long life.” These phrases are simple yet powerful, conveying heartfelt emotions succinctly.

Table of Contents

Two Options for Filing Your 941-X

When it comes to completing and submitting your 941-X, you have two main options:

Option 1: Do It Yourself Step-by-Step

You can attempt to file the 941-X form on your own by following the IRS instructions carefully. Here are the key steps involved:

- Gather Documents: Collect your original 941 forms, payroll records, calculations for credits/corrections, and any other supporting documents.

- Download Form 941-X: Get the latest version of the form from irs.gov.

- Read Instructions Thoroughly: The instructions explain how to complete each line to claim credits or make corrections properly.

- Complete the Form: Transfer over your business info, then work line-by-line calculating adjustments needed.

- Review and File: Double-check all entries, include any attachments, and make copies for your records before mailing.

While doing it yourself may save on professional fees, the 941-X is notoriously complex. One small mistake could delay your refund or cause the IRS to deny valid claims. Having a tax professional review your work is highly recommended if going this route.

Option 2: Hire an Experienced 941-X Tax Professional

Your other option is to bring in a firm that specializes in 941-X amended returns and tax credit claims like the Employee Retention Credit (ERC). The benefits include:

- Expertise: They live and breathe the latest 941-X rules to maximize your credits.

- Accuracy: Professionals reduce errors that can delay or jeopardize your refund.

- Time Savings: You don’t have to spend hours deciphering IRS instructions.

- Documentation: They know exactly what records to provide for a smooth filing.

While you’ll pay a fee for this service, it ensures you receive the full refund amount you qualify for. Fees can actually be covered by the extra credits a skilled preparer can claim.

When hiring a 941-X firm, look for:

- Certified tax professionals (CPAs, EAs, etc.)

- Specific experience with payroll tax issues and ERC

- Proven track record with positive client reviews

- Upfront, transparent pricing and contract terms

“We hired a reputable 941-X specialist, and they got our company over $350,000 in ERC refunds we would have completely missed filing ourselves.” – John D., Restaurant Owner

Where to Mail 941-X Forms – IRS Addresses

Once your 941-X form is complete and you have copies of all supporting documents, it’s time to mail in your package to the correct IRS address based on your business location:

| If Your Business Is Located In… | Mail 941-X Package To… |

| Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of Treasury <br> Internal Revenue Service <br> Cincinnati, OH 45999-0005 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of Treasury <br> Internal Revenue Service <br> Ogden, UT 84201-0005 |

Include all supporting documents securely in one complete package when mailing. The IRS will return an incomplete 941-X without processing it.

What happens after mailing? The IRS processing time for 941-X amended returns can take 8-16 weeks currently. You should receive a notice in the mail once processed with the refund amount approved or any other adjustments needed.

Read this Post: WHY HAVEN’T I GOTTEN MY ERC REFUND YET

Common 941-X Mistakes to Avoid

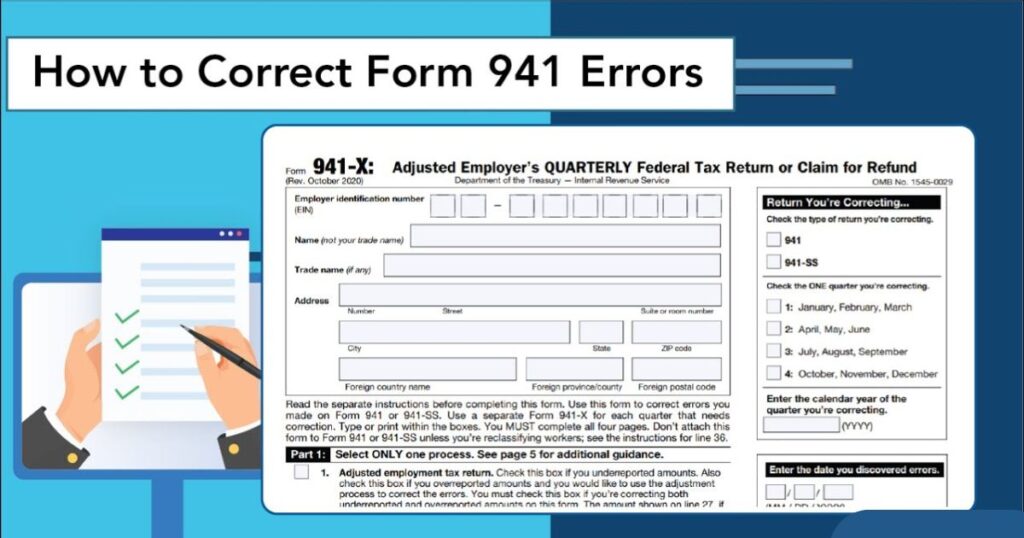

To prevent delays, denials, and headaches with your 941-X filing, watch out for these common pitfalls:

Not Filing for Eligible Credits

- Many businesses overlook lucrative credits like the Employee Retention Credit (ERC) which refunds payroll taxes for businesses impacted by COVID-19.

- Make sure to claim every credit and refund opportunity you qualify for.

Math Errors on Calculations

- Seemingly small calculation mistakes when determining adjustments can completely throw off your figures.

- Use Excel templates or tax software to double-check all calculations.

Missing Supporting Documents

- The IRS wants documentation to validate claims on your 941-X.

- Maintain meticulous records for items like payroll, revenue impacts, state/local orders, etc.

Filing for Wrong Quarters/Years

- Pay careful attention to the periods you are amending.

- You may need to file multiple 941-X forms for different quarterly periods.

When to File 941-X Forms

In general, you have 3 years from the original filing date of your 941 to submit an amended 941-X form for refund claims. Some key timeframes:

COVID Tax Relief Extensions

- Employers have until April 2024 to retroactively claim the ERC for 2020 and 2021.

Quarterly vs. Annual

- You can amend quarterly, or annual returns if you file annually.

- Amending one quarter doesn’t automatically correct others – you need separate 941-X forms.

Best Months to File

- Filing in early Q1 (January-March) before the IRS backlog builds can lead to faster processing.

- Avoid peak times like April 15th and fall months when the IRS is inundated.

941-X Example Walkthrough

To give you a real-world look at how to complete the 941-X line-by-line, let’s walk through an example scenario:

Example: A restaurant business is claiming the Employee Retention Credit for 2021 after initially not taking it. They need to amend Form 941 for all four quarters to receive their full $187,000 credit refund.

- Starting Information:

- Original 941s filed

- Documented payroll records for 2021

- Proof of COVID-19 impacts per ERC requirements

- Entering Information:

Enter basic details like business name, EIN, and the quarter/year you’re amending. Mark reason as “claiming a credit.”

Enter new payroll values for lines 5a-5e to account for ERC figures. For example, Line 5a reflects total $840,000 qualified wages.

- Calculating ERC Credit

- Use worksheet supplied to calculate 70% credit based on qualified wages

- Total ERC credit of $187,200 from qualified wages of $280,000

- Reporting Credit

- Transfer credit amount to line 24 of Form 941-X

- This becomes refund claimed after subtracting from taxes already paid

- Attaching Documents

- Include all payroll and documentation proving ERC eligibility

- Form 7200 for ERC advance credits already claimed

- Ensure all amended figures are reflected across all forms

Following this line-by-line is crucial to avoid errors that can delay or invalidate your 941-X credit claims. Working with a professional 941-X service can simplify this process.

941-X FAQ’s Section

Here are answers to some frequently asked questions about the 941-X process:

Who qualifies for credits like the Employee Retention Credit?

The ERC is available to any private business of any size that experienced:

- Full/partial COVID suspensions by government order

- Gross receipts declined by 20%+ compared to 2019

What documentation is needed to claim refund credits?

Common records needed include payroll tax returns, payroll reports, financial statements showing declines, state/local closure orders, and other proof of impacts. An organized file is essential.

How can I check the status of my 941-X?

You can check on the status of your 941-X amended return a few different ways:

- Allow at least 8 weeks for processing, then call the IRS at 800-829-4933

- Check your IRS online account transcript for updates

- Wait for mail correspondence from the IRS regarding any additional documentation needed or refund details

What if the IRS denies or pushback on my 941-X claims?

If the IRS disagrees with all or part of your 941-X filing, they will issue a notice explaining the adjustments and amount still owed. You have appeal rights which must be exercised quickly (60 days or less typically).

Hire a tax professional experienced in IRS audits and appeals to strengthen your case with:

- Legal citations and explanations refuting the IRS’s position

- Additional documentation supporting your qualified credits/claims

- In-person or written protest and appeal submissions

How long does it take to receive my refund after filing a 941-X?

Upon approval of your 941-X, the typical timeframe is:

- 4-6 weeks for refunds under $1 million

- 8-12 weeks for larger refund amounts over $1 million

You can check https://www.irs.gov/refunds for the latest processing timeframes. Interest may also be tacked onto refund amounts for long-delayed claims.

Ensure You Claim Every 941-X Refund Dollar Owed

As this guide illustrates, the process of amending payroll tax returns via Form 941-X is filled with nuances and complexities. One mistake can be costly in terms of missed credits, processing delays, or outright denials costing your business thousands in refunds.

“Working with a specialized 941-X firm gave me confidence we were claiming the maximum refund amount we deserved while avoiding compliance risks. Well worth the fee compared to my previous struggles with these forms alone.” – Sarah B., Manufacturer

While the DIY route is possible, most businesses save substantial time and money by enlisting an experienced payroll tax professional to handle their 941-X filings accurately. Their expertise ensures no opportunities are missed while minimizing potential audits down the road.

If you have additional questions about where to mail 941-X forms, amending to claim credits like ERC, or other 941-X issues – reach out to a reputable firm for a free consultation. Getting these amended returns done right is paramount for your bottom line.